The vast majority of the wedge continuation patterns you'll see form in the market will form as retracements during up or down moves. Their formation will take place during the whole duration of the retracement, and the breakout seen at the end of each pattern will usually signal an end to not only the patterns 11/05/ · A continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, Estimated Reading Time: 2 mins 31/10/ · Yes, continuation patterns are the same for forex and stock trading. While there are noticeable differences when comparing forex vs stocks, continuation patterns can be applied with the same Estimated Reading Time: 6 mins

Forex Continuation Patterns | Trading continuation patterns

Then, based on our predictions, we take action to make as much profit as we can. To accomplish this, you need to constantly study the behaviour of trends.

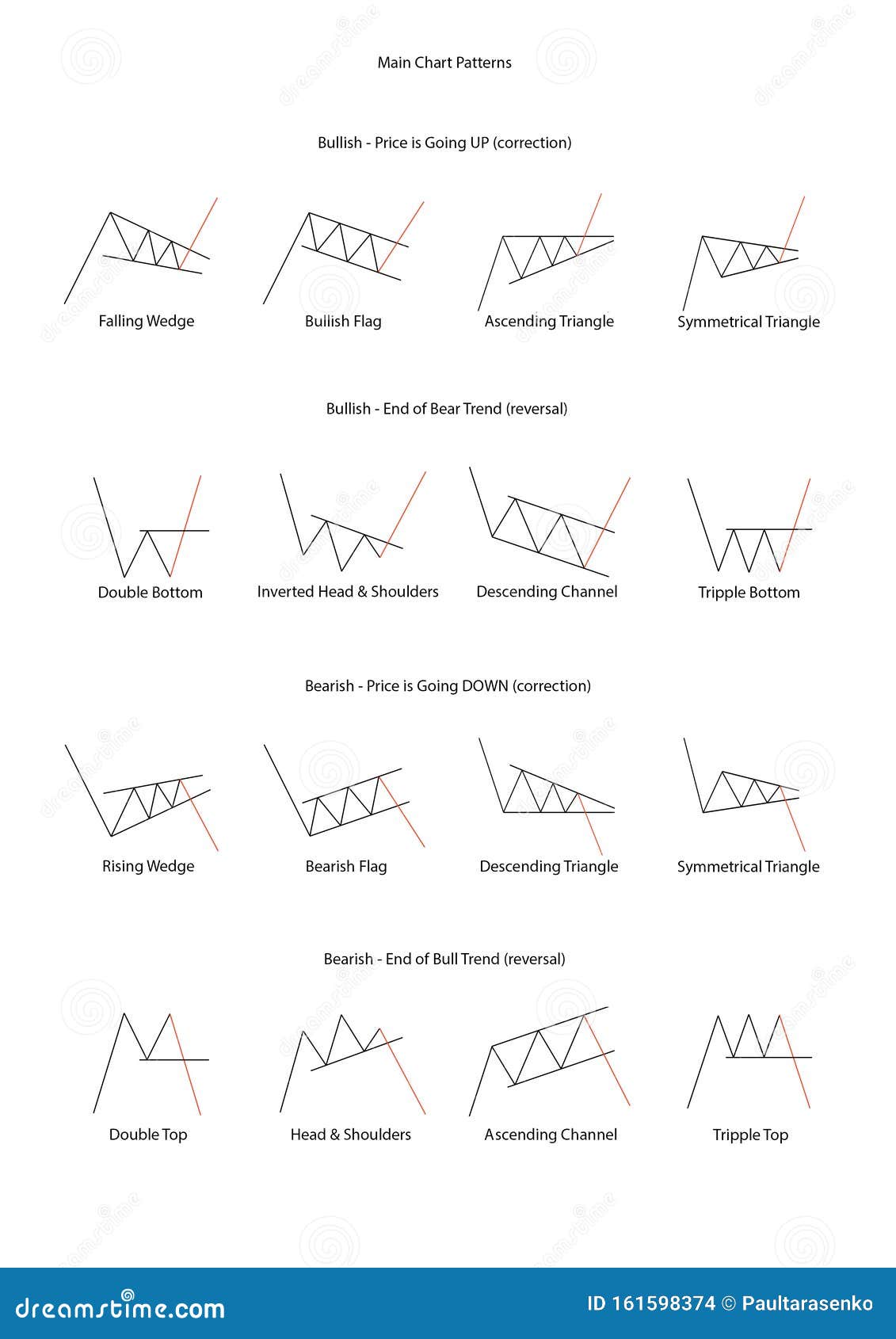

One of the basic principles you need to fully understand is Forex continuation patterns. They help us predict that after a period of consolidation, the trend will continue its course or not. The patterns are defined figures you can draw in the chart matching the highest and lowest price points during the consolidation.

This will continue after the consolidation phase if we had a strong uptrend before the pattern, continiuation pattern forex. But if the previous trend was downwards, the price would continue to go down after continiuation pattern forex pause. Once the trader understands how the principles of this theory work, he can make his own strategy to get the maximum profit from the movement.

Many people have different theories about continuation patterns. These are:, continiuation pattern forex. Trade Popular Markets with Our Top 3 Brokers. Try their Risk-Free Demo Account! Enjoy same-day withdrawals. Review Visit Site Visit Site CFD service. Your capital is at risk. Remember that CFDs are a leveraged product and can result in the loss of your continiuation pattern forex capital.

Please ensure you fully understand the risks involved. com providers a unique trading experience for forex and stock traders alike. They are a multi-regulated broker which includes the FSCA. Triangles Triangles are famous continuation patterns. We have two main types of triangles discussed below.

In all the triangles, because the lines that form it are converging, you can estimate the period where the price will be out of the formed figure. How to play it: The trader has to play a long position and buy after the breakout.

The moment to sell will be when the uptrend after the breakout equals the maximum height of the triangle. It is characterized by a horizontal support line and lower highs. They are normally presented with a downtrend that, after presenting the ascending triangle, continues to be bearish.

Descending triangles can be seen with upward trends, although these are less common. For this to work, we need a downward trend before a triangle. Unfortunately, continiuation pattern forex, in sideways markets, this does not work because we cannot draw conclusions from it. How to play it: Here, the trader will go short by selling an asset before it depreciates furhter.

When depreciation has occurred, the trader can book profit. The time to exit is when the fall equals the maximum height of the triangle. Pennants are another type of continuation patterns that predispose us to continue with the same trend. They are similar to triangles and continiuation pattern forex produced after a very intense, almost vertical movement.

The difference between a pennant and a symmetrical triangle is the size. The flags are smaller triangles. It mostly occurs in a strong uptrend. The pennant is formed from an upward flag pole. It is a consolidation period, continiuation pattern forex, and it shows a probability of continuation of the uptrend after a breakout.

The formed triangle is small, so the breakout happens quickly, continiuation pattern forex. How to play it: The trader has to play a long position. Buy low after the breakout.

The time to exit will be when the continiuation pattern forex after the breakout equals the length of the pole. It occurs in strong downtrends, continiuation pattern forex.

Traders look for a break below the pennant to take advantage of the bearish momentum. How to play it: Here, the trader will go short before an asset depreciates. Then, when depreciation has occurred, the trader can exit the position with profit. The time to close the deal is when the downtrend after the breakout equals the length of the pole. This pullback is one of the reasons why the strategy of each trader varies. For example, if a trader enters right after the breakout, he may be out of the trade if the pullback is enough to hit his stop-loss.

Continiuation pattern forex there is a problem with that strategy. If there is no pullback, the trader waiting for it will be out of the trade. Flags are another continuation pattern characterized by a strong move before the consolidation period.

Flags are formed by two parallel lines going against the previous trend. The lines can also be horizontal. After a strong uptrend, the continiuation pattern forex of the flag in the consolidation phase will show a downtrend right before the breakout continues the uptrend. The time to sell will be when the uptrend after the breakout equals the length of the pole. Finally, the pattern ends after the breakout continues its downward trend.

If we look at the image above, we continiuation pattern forex see that the trend goes down even lower than the target point after the breakout. How to play it: Here, the trader will go short by selling the asset before it depreciates.

Then, when depreciation has occurred, the trader book the profit. The difference between a rectangle and a horizontal flag is the length of the consolidation, continiuation pattern forex. The rectangle allows us continiuation pattern forex trade before the breakout. In the case of rectangles, it is a little more uncertain whether the trend will continue or reverse. However, it is an important pattern to keep in mind. Continiuation pattern forex the trend is reversed instead of continuing, we simply act accordingly, adapting to the behaviour of the market.

The continuation patterns help us to predict the behaviour of the assets to design a good strategy. The most common continuation patterns are Triangles, Flags, Pennant, and Rectangles. We can play continiuation pattern forex no matter if they are bullish or bearish patterns. One should keep in mind that we are not guessing whether the price will go up or down.

During the consolidation period, we are not supposed to act except in the rectangles. We continiuation pattern forex supposed to enter the game once we have seen that the breakout occurred as we were expecting it to happen.

I have read and agree to the Privacy Policy. Heinrich is a Forex and CFD enthusiast with a passion for writing good informative quality content. He strives to showcase the best Forex Brokers in South Africa, continiuation pattern forex. Join him on his Journey! There's been an increase in popularity with CFD trading in South Africa. With an increase…, continiuation pattern forex.

Username or Email Address, continiuation pattern forex. Remember Me. This website uses cookies to ensure you get the best experience on our website. Read Review. Home Forex Trading Course Forex Continuation Patterns.

Forex Continuation Patterns Categories: Forex Trading Course Author: Heinrich Le Roux. Date: 14 Jul Table of contents What are continuation continiuation pattern forex Types of continuation patterns Triangles Ascending triangle Descending Triangle Pennants Bullish pennant Pattern Bearish pennant pattern Flags Bullish flag pattern Bearish flag pattern Rectangles Bottom line.

Blackstone Futures is continiuation pattern forex truly local FSCA regulated broker with offices in Rosebank Johannesburg. Visit Site Visit Site. With currency pairs, Exness provides leading coverage. Categories: Forex Trading Course Author: Heinrich Le Roux.

Heinrich Le Roux. Content Writer Market Analyst. What is Forex? You've probably heard the term forex but have no clue continiuation pattern forex it's all about. What is Forex Trading? What is CFD Trading in South Africa? How Does Forex Trading Work? How to Trade Forex?

95% Winning Forex Trading Formula - The Forex Master Pattern��

, time: 37:53Forex Patterns: What are they and how to read them

Ascending and descending triangles are also referred to as "right-angle" triangles.. Generally, a triangle pattern is considered to be a continuation or consolidation blogger.commes, however, the formation marks a reversal of a trend. Descending triangles are generally considered bearish Trend continuation patterns are formed during the pause in the current market trends, and mark rather the movement continuation than its reversal. By contrast with the model of trend reversal, the figures are often formed at shorter time intervals The vast majority of the wedge continuation patterns you'll see form in the market will form as retracements during up or down moves. Their formation will take place during the whole duration of the retracement, and the breakout seen at the end of each pattern will usually signal an end to not only the patterns

No comments:

Post a Comment