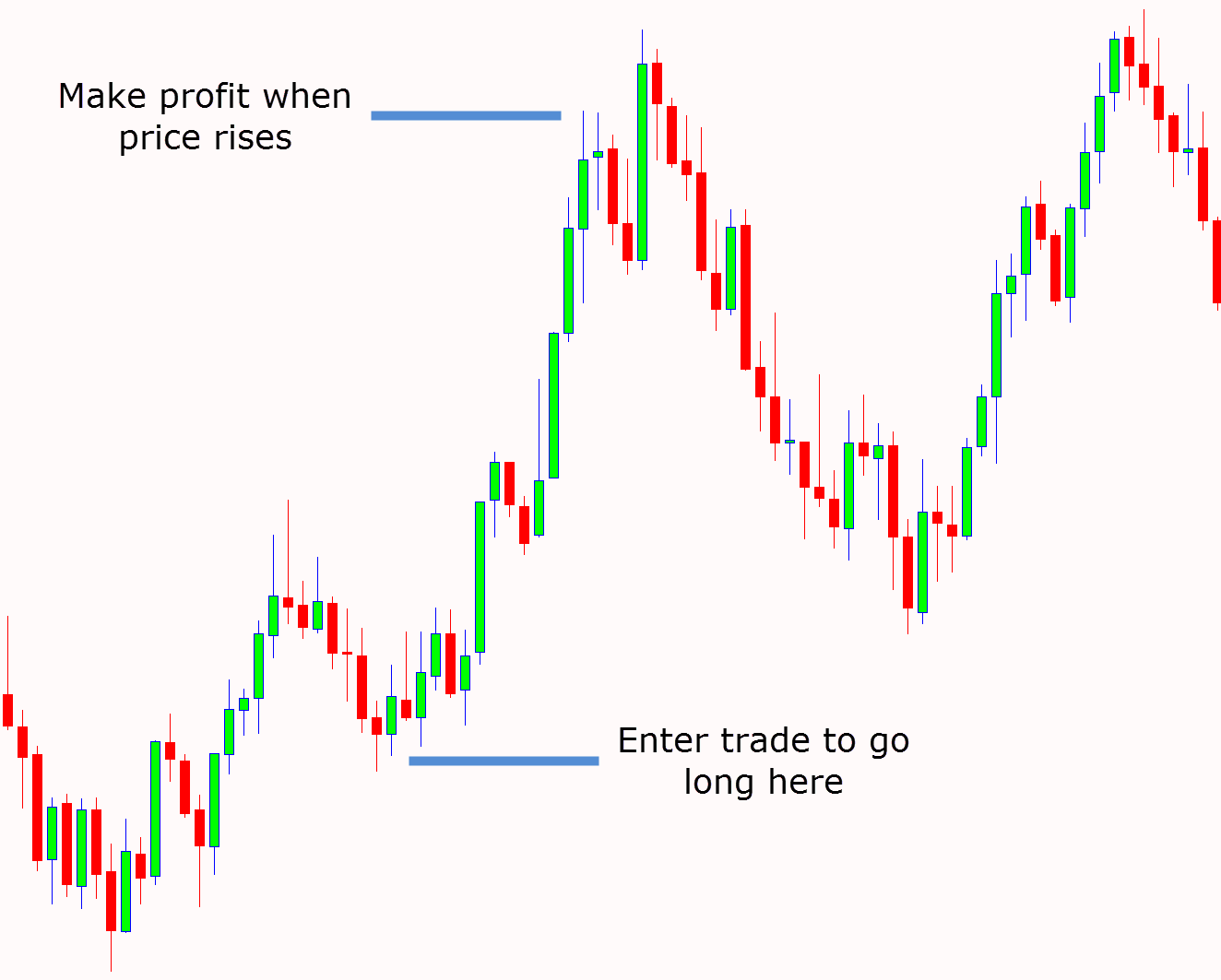

3/15/ · This article will look at Forex trading for beginners, and will introduce some simple Forex trading blogger.com particular, this article will guide you through three key Forex trading strategies that beginners can use, namely, the Breakout strategy, the Moving Average Crossover strategy, and the Carry Trade strategy 1/14/ · The spread in Forex trading refers to the difference in the sell (bid) and buy (ask) price of a currency quote. The ask price is always higher than the bid price, and by default, traders face a loss when opening a trade. Brokers apply mark-ups on currency pairs, which represent their blogger.com Time: 2 hrs 10 mins 1/28/ · Three simple Forex trading strategies. Below is an explanation of three Forex trading strategies for beginners: Breakout. This long-term strategy uses breaks as trading signals. Markets sometimes swing between support and resistance bands. This is known as consolidation

How to Trade Forex: 12 Steps (with Pictures) - wikiHow

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. The foreign exchange market is where currencies are traded. Currencies are how to trade forex as a beginner because enable purchase of goods and services locally and across borders.

International currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros EUR. This means that the U. importer would have to exchange the equivalent value of U.

dollars How to trade forex as a beginner into euros. The same goes for traveling. A French tourist in Egypt can't pay in euros to see the pyramids because it's not the locally accepted currency.

As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. One unique aspect of this international market is that there is no central marketplace for foreign exchange.

Rather, currency trading is conducted electronically over-the-counter OTCwhich means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney—across almost every time zone.

This means that when the trading day in the U. ends, how to trade forex as a beginner, the forex how to trade forex as a beginner begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

In its most basic sense, the forex market has been around for centuries. People have always exchanged or bartered goods and currencies to purchase goods and services. However, the forex market, as we understand it today, is a relatively modern invention.

After the accord at Bretton Woods inmore currencies were allowed to float freely against one another. The values of individual currencies vary based on demand and circulation and they are monitored by foreign exchange trading services.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors. There are two distinct features to currencies as an asset class :. An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate.

Prior to the financial crisis, it was very common to short the Japanese yen JPY and buy British pounds GBP because the interest rate differential was very large. This strategy is sometimes referred to as a " carry trade. Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporationshedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market.

Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance. The FX market is where currencies are traded. It is the only truly continuous and nonstop trading market in the world. In the past, how to trade forex as a beginner, the forex market was dominated by institutional firms and large banks, how to trade forex as a beginner, who acted on behalf of clients.

But it has become more retail-oriented in recent years and traders and investors of many holding sizes have begun participating in it. An interesting aspect of world forex markets is that there are no physical buildings that function as trading venues for the markets.

Instead, it is a series of connections made through trading terminals and computer how to trade forex as a beginner. Participants in this market are institutions, investment banks, commercial banks, and retail investors. The foreign exchange market is considered more opaque as compared to other financial markets. Currencies are traded in OTC markets, where disclosures are not mandatory. Large liquidity pools from institutional firms are a prevalent feature of the market.

The survey found that the motives of large financial institutions played the most important role in determining currency prices. There are three ways to trade Forex. They are as follows:. Previously, volumes in the futures and forwards markets surpassed those of the spot market. However, the trading volumes for forex spot markets received a boost with the advent of electronic trading and proliferation of forex brokers.

When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to how to trade forex as a beginner more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future. The spot market is where currencies are bought and sold based on their trading price.

That price is determined by supply and demand and is calculated based on several factors including current interest rates, economic performance, sentiment towards ongoing political situations both locally and internationally as well as the perception of the future performance of one currency against another.

A finalized deal is known as a "spot deal. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present rather than the futurethese trades actually take two days for settlement. A forward contract is a private agreement between two parties to buy a currency at a future date and at a pre-determined price in the OTC markets. A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and at a predetermined price.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange.

In the U. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the how to trade forex as a beginner, providing clearance and settlement. Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire.

The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, how to trade forex as a beginner, big international corporations use these markets in order to hedge against future how to trade forex as a beginner rate fluctuations, but speculators take part in these markets as well. Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market.

These terms are synonymous and all refer how to trade forex as a beginner the forex market. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U. A stronger dollar resulted in a much smaller profit than expected. The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders.

If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade. Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority.

However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world. Factors like interest ratestrade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another.

A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs, how to trade forex as a beginner. Imagine a trader who expects interest rates to rise in the U. The trader believes higher interest rates in the U.

If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value. Trading currencies can be risky and complex.

The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated. The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit riskand they have established internal processes to keep themselves as safe as possible.

Regulations like this are industry-imposed for the protection of each participating bank. Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency.

This system helps create transparency in the market for investors with access to interbank dealing. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe. Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.

or the U. dealers in the U.

How to Start as a Forex Trader - Forex for Beginners 2020

, time: 8:34How to start Forex trading for beginners - All the steps summarized

3/23/ · There are several basic attributes of forex trading. To start, it is important for traders to learn what currency pairs exist or are on offer at brokers. For most, trading major currency pairs such Author: CMS Prime There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always 10/8/ · Forex Trading Strategies for Beginners. Forex traders employ different trading styles that mostly fit their own personalities. We can break down Forex market trading strategies into four distinctive trading edges that can be used in different market environments: Forex scalping strategies (Simple Scalping Trading Strategy: The Best Scalping System)

No comments:

Post a Comment