08/03/ · So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital Forex Leverage: A Double-Edged Sword Defining Leverage. Leverage involves borrowing a certain amount of the money needed to invest in something. In the case Leverage in Forex Trading. In the foreign exchange markets, leverage is commonly as high as This means that for Risk of 30/03/ · What is Leverage in Forex? Financial leverage is essentially an account boost for Forex traders. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with

What is leverage in Forex trading? Which leverage ratio is best? - Admirals

Leverage is the use of borrowed money called capital to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency.

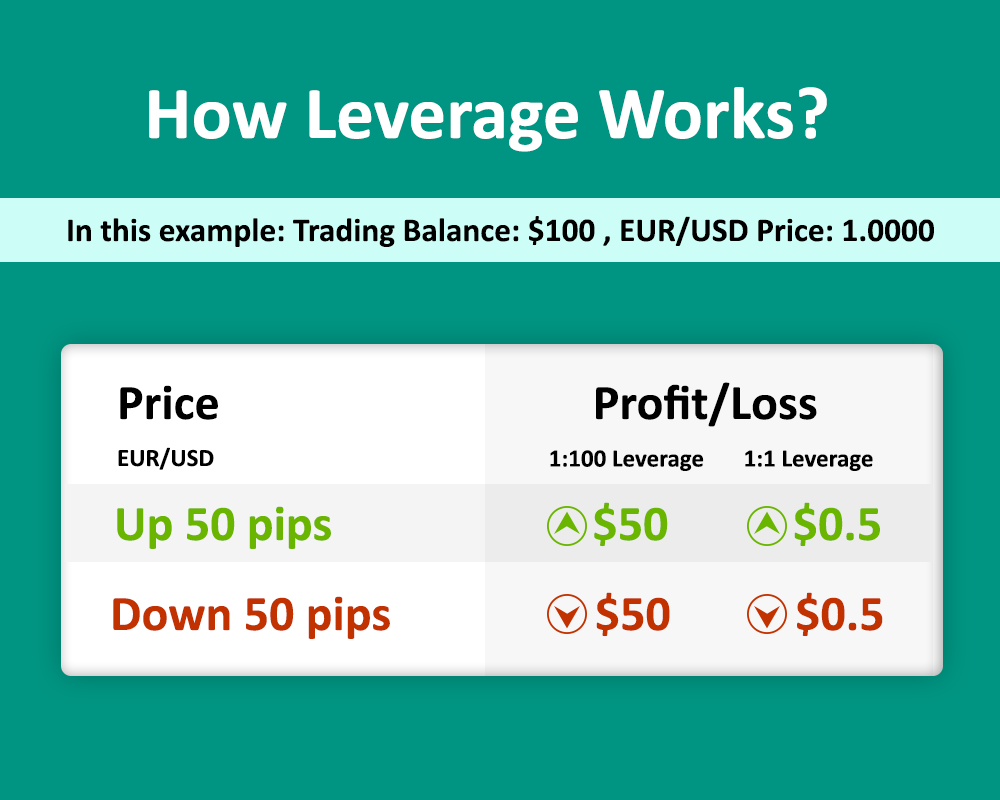

As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged swordforex leverage, meaning it can also magnify losses, forex leverage. It's important that forex traders learn how to manage leverage and employ forex leverage management strategies to mitigate forex losses.

Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price. For example, an investor might buy the euro versus the U. The difference between the buy and sell exchange rates would represent the gain or loss on the trade.

Investors use leverage to enhance the profit from forex trading. The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount forex leverage size forex leverage the trade based on the leverage that they desire.

However, the broker will require a percentage of the trade's notional forex leverage to be held in the account as cash, which is called the initial margin, forex leverage.

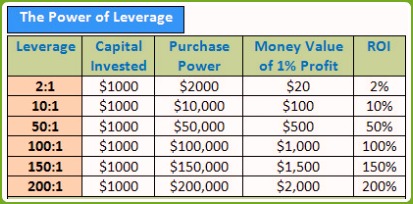

The initial margin required by each broker can vary, depending on the size of the trade. The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Below are examples of margin requirements and the corresponding leverage ratios.

As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade. However, a broker may require higher margin requirements, forex leverage on the particular currency being traded. For example, the exchange rate for the British pound versus Japanese yen can be quite volatile, meaning it can fluctuate wildly leading to large swings in the rate. A broker may want more money held as collateral i. A broker can require different margin requirements for larger trades versus smaller forex leverage. Standard trading is done onunits of currency, so for a trade of this size, the leverage provided might be or However, forex leverage, a new account probably won't qualify for leverage.

Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. However, the leverage allowed might only bedespite the increased amount of collateral, forex leverage. Forex brokers have to manage their risk and in doing so, may increase a trader's margin requirement or reduce the leverage ratio and ultimately, the position size. Leverage in the forex markets tends to be significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market.

If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage. Although the ability to earn significant profits by forex leverage leverage is substantial, leverage can also work forex leverage investors. For example, if the currency underlying one of your trades moves in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid a catastrophe, forex leverage, forex traders usually implement a strict trading style that includes the use of stop-loss orders to control potential losses, forex leverage.

A stop-loss is a trade order with the broker to exit a position at a certain price level. In this way, a trader can cap the losses on a trade, forex leverage. Forex Brokers. Your Money. Personal Finance, forex leverage. Your Practice. Popular Courses. Table of Contents Expand. Understanding Leverage in the Forex Market. Types of Leverage Ratios. Forex Leverage and Trade Size. The Risks forex leverage Leverage. Key Takeaways Leverage, which is the use of borrowed money to invest, is very common in forex trading.

However, forex leverage, leverage is forex leverage double-edged sword, meaning it can also magnify losses. Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can forex leverage higher for certain currencies. Take the Next Step to Invest. Advertiser Disclosure ×, forex leverage.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Forex Brokers 5 Tips For Selecting A Forex Broker. Partner Links. Related Terms What Is Forex FX and How Does Forex leverage Work?

Forex FX is the market for forex leverage international currencies. The name is a portmanteau of the words foreign and exchange, forex leverage. Forex Scalping Definition Forex leverage scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements.

How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Margin Debt Margin debt is debt a brokerage customer takes on by trading on margin, meaning they borrow part of the initial capital to buy a stock from their broker.

Inside the Interest Rate Differential — IRD An interest rate differential IRD measures the gap in interest rates between two similar interest-bearing assets. Currency Pair Definition Forex leverage currency pair is the quotation of one currency against another.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

Lesson 10: All about margin and leverage in forex trading

, time: 23:38Forex Leverage: A Double-Edged Sword

08/03/ · So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital Forex Leverage: A Double-Edged Sword Defining Leverage. Leverage involves borrowing a certain amount of the money needed to invest in something. In the case Leverage in Forex Trading. In the foreign exchange markets, leverage is commonly as high as This means that for Risk of 30/03/ · What is Leverage in Forex? Financial leverage is essentially an account boost for Forex traders. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with

No comments:

Post a Comment