30 Min ATR Breakout Forex Trading Strategy. The 30 minute ATR Breakout Forex Trading Strategy is an advanced forex trading strategy and for new forex traders, it might take a while for you to understand. Timeframes: 30 minutes. Currency Pairs that you can trade: any With that being said, here is a minute MACD Forex trading strategy that you may want to try for yourself. Indicators and Chart Setup The indicators that will be used in this trading strategy are the Master MACD indicator, the Exponential Moving Averages, 30 min strategy ia an trading system based on moving average and macd indicator

30 Min ATR Breakout Forex Trading Strategy

Day traders are attracted to the foreign exchange market because of its high volatility and by the fact that the Forex market is constantly in operation from Monday to Friday. This means that profits may be made at literally any point in time even while local trading sessions may have ended. Because the forex market is global in scope, trading may take place at any time since there is always at least one session that is open.

With that being said, here is a minute MACD Forex trading strategy that you may want to try for forex 30 min strategy. The indicators that will be used in this trading strategy are the Master MACD indicator, the Exponential Moving Averages, and the CCI indicator, forex 30 min strategy.

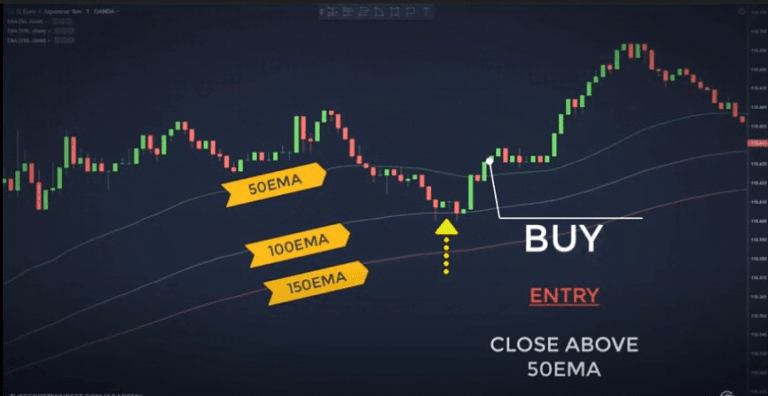

The chart setup for this trade is as follows: Two Exponential Moving Averages: faster - 14 violet and slower - 21 blue The Master MACD trend indicator Standard CCI period 14 This trade may be set up in any session using the currency pair of your choice. However, the preferred time forex 30 min strategy are 1-minute, 5-minute, minute, minute or 1-hour time frame. You should place a trade if any of the following scenarios occur: Look for the 14 EMA violet to cross above the 21 EMA blue.

This is an indication that price will be driven upwards. Another buy signal is when the histogram of the Master MACD breaks above the 0. A third indicator that you should buy is if the CCI indicator breaks above the 0. You should place your stop loss below the short-term support area. The image above shows a visual representation of what your chart is likely to look like for a great buy entry.

Look if the 14 EMA crosses below the 21 EMA. If this obtains, take profits and exit the trade. Another take profit signal is if the Master MACD histogram falls below the 0. Once the blue line of the CCI indicator breaks below the 0. If the histogram of the Master MACD Indicator breaks below the 0. Place your stop loss above the short-term resistance area. Take profits under these circumstances: If the EMAs cross in the opposite direction of a sell signal 14 EMA goes above 21 EMA.

If the histogram of the Master MACD goes above the 0. Here is an illustration of a sell entry trade:, forex 30 min strategy. Try Best Orders Execution - Trade Better! Very Profitable The buy forex 30 min strategy is shown with the 3 circles on the left the 3 conditions for a buy tradewhile the vertical line indicates the exit signal CCI moving below The sell signal is shown with the 3 circles on the left the 3 conditions for a sell tradewhile the vertical line indicates the exit signal CCI moving above

FOREX GAMEBREAKER MOBILE STRATEGY - MAKE $200-$1000+ TRADING NEWS / NFP IN 30 MINS OR LESS

, time: 51:06

30 min strategy ia an trading system based on moving average and macd indicator 30 Min ATR Breakout Forex Trading Strategy. The 30 minute ATR Breakout Forex Trading Strategy is an advanced forex trading strategy and for new forex traders, it might take a while for you to understand. Timeframes: 30 minutes. Currency Pairs that you can trade: any With that being said, here is a minute MACD Forex trading strategy that you may want to try for yourself. Indicators and Chart Setup The indicators that will be used in this trading strategy are the Master MACD indicator, the Exponential Moving Averages,

No comments:

Post a Comment