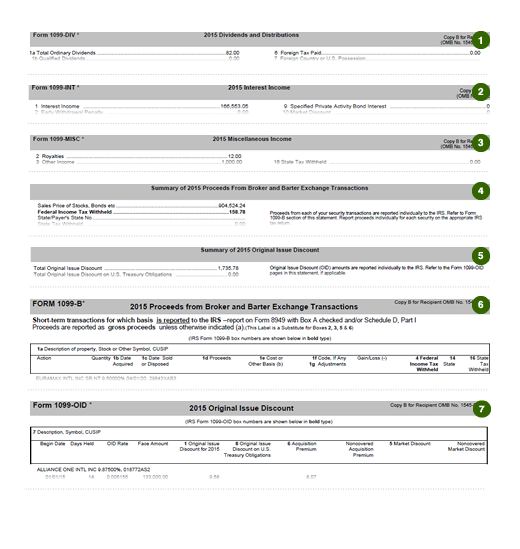

cases, basis for) transactions to you and the IRS on Form B. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. You may be required to recognize gain from the receipt of cash, stock, or other property that 06/06/ · Forex tax calculation, if you are with a broker that doesnt provide B? then how do we report forex tax? By default, retail FOREX traders fall under Section , which covers short-term foreign exchange contracts like spot FOREX trades. Section taxes FOREX gains and losses like ordinary income, which is at a higher rate than the capital gains tax for most earners. An advantage of Section 16/08/ · Example tax return footnote for a forex client who received a Form Taxpayer received a Form treating his forex contracts like forwards (or forward-like). issuance rules state that a should be issued for forex forwards, treating them like Section (g) foreign currency contracts. securities traders face a barrage of problems with new IRS cost-basis reporting rules for B

Forex Account Applications | blogger.com

Brokers calculate wash sales based on identical positions an exact symbol only per separate brokerage account. Forex 1099b the wash sale loss rules for taxpayers, Sectionrequires taxpayers to calculate wash sales based on substantially forex 1099b positions between equities and equity options and equity options at different exercise dates across all their individual accounts including IRAs — forex 1099b Roth IRAs.

Many tax preparers and taxpayers continue to disregard Section rules, even after acknowledging differences with broker B rules. They do so at their peril if caught by the IRS. Securities accounting is challenging Securities brokers are making advances in tax-compliance reporting. Phase-in is almost complete: Equity option transactions and simple debt instruments acquired on January 1, forex 1099b, or later were reported for the first time on Bs for tax year The only cost-basis reporting item remaining to be phased-in is reporting complex debt instruments starting on January 1, or later.

Tax-year Bs should be the same as in Taxpayers report proceeds, cost basis, wash sale loss forex 1099b other adjustments, holding period and capital gain or loss — short term vs. long-term held over 12 months on Form After all, the IRS gets a copy of the B with all the details.

Form problems: apples vs. oranges with Bs In accordance with IRS rules for forex 1099b, a B reports wash sales per that one brokerage account based on identical positions. The wash sale rules are different for taxpayers, who must calculate wash sales based on substantially identical positions across all their accounts including joint, spouse and IRAs.

With different rules for brokers vs, forex 1099b. taxpayers apples vs. A broker may report no wash sales when in fact a taxpayer may have many wash sale losses. A taxpayer may permanently lose a wash sale loss between a taxable and IRA account, but a broker will never report that on a B. In some cases, a broker can report a wash sale loss deferral at year-end, but the taxpayer may have absorbed the wash sale loss in another account, thereby eliminating this forex 1099b problem at year-end.

This problem of different rules on wash sales for brokers vs. taxpayers is still widely unknown by many taxpayers and tax preparers. Far too many continue to omit Form or file an incorrect Form relying solely on broker B reporting when they should be using forex 1099b trade accounting software to properly calculate and report wash sale loss adjustments.

A predicament for some tax preparers who do understand the problem is that calculating wash sales correctly leads to un-reconciled differences between Form and Bs. To better close the tax gap, Congress should realign broker and taxpayer wash sale rules to be the same, forex 1099b. There is one scenario where a taxpayer can solely rely on a B and skip filing Form by entering B forex 1099b on Schedule D: when the taxpayer has only one brokerage account and trades equities only with no trading in equity options, which are substantially identical positions.

Plus, the taxpayer must not have any wash sale loss or other adjustments. In that narrow case, there are apples vs. apples — only one account and substantially identical is the same as identical. This forex 1099b of apples vs.

oranges is biggest for individuals who tend to have multiple accounts. There is a solution for traders who qualify for TTS. Trade in an entity and elect Section MTM, forex 1099b, which is exempt from wash sale rules, forex 1099b. Keep investment accounts with far less wash sale loss activity on the individual level. Section wash sale rules Per IRS Publication A wash sale occurs when you a taxpayer sell or trade stock or securities at a loss and within 30 days before or after the sale you:, forex 1099b.

Here is an example of broker rules: an account holder sells 1, shares of Apple stock for a loss and buys back 1, shares of Apple stock 30 days before or 30 days forex 1099b. Broker computer systems are programmed to calculate wash sales based on an identical symbol, and stock and options and options at different exercise dates have different symbols.

This can be forex 1099b big problem or challenge for active traders who trade stocks and options, or just options but with constant changes in exercise dates. Starting inBs included equity options for the first time. This causes confusion and anxiety for many taxpayers, who draw the wrong conclusion and may think they have a huge problem at year-end, when they may not. What counts more is what wash sales are deferred at year-end, and what ones were permanently lost to Forex 1099b accounts.

In effect, forex 1099b, they are using broker forex 1099b and unknowingly or willfully disregarding Section While tax preparers may be covered for malpractice, they will have Circular penalties and ignorance is not an acceptable excuse. Consider a Section election Business traders qualifying for TTS are entitled to elect Section mark-to-market MTM accounting elected on a timely basis, which exempts them from wash sale loss adjustments and the capital loss limitation.

Section business trades are not reported on Form ; they use Form Part II ordinary gain or loss, forex 1099b. Although Section extricates traders from the compliance headaches of Formit does not change their requirement for line-by-line reporting on Form We recommend trade accounting software to generate Form A consumer off-the-shelf accounting program is fine for keeping track of expenses, non-trading income, home office deductions and itemized deductions.

On our Website accounting services page, learn more about trade accounting software. Choose our professional accounting service using this software, forex 1099b.

How to Read Your Brokerage 1099 Tax Form

, time: 6:03About Form B, Proceeds from Broker and Barter Exchange Transactions | Internal Revenue Service

16/08/ · Example tax return footnote for a forex client who received a Form Taxpayer received a Form treating his forex contracts like forwards (or forward-like). issuance rules state that a should be issued for forex forwards, treating them like Section (g) foreign currency contracts. securities traders face a barrage of problems with new IRS cost-basis reporting rules for B 09/12/ · Forex accounting and tax reporting Summary reporting is used for forex trades and most brokers offer good online tax reports. Spot forex brokers aren’t supposed to issue Form Bs at tax time. Section is realized gain or loss, whereas with a capital gains election into Section (g), mark-to-market (MTM) treatment should be used 06/06/ · Forex tax calculation, if you are with a broker that doesnt provide B? then how do we report forex tax? By default, retail FOREX traders fall under Section , which covers short-term foreign exchange contracts like spot FOREX trades. Section taxes FOREX gains and losses like ordinary income, which is at a higher rate than the capital gains tax for most earners. An advantage of Section

No comments:

Post a Comment