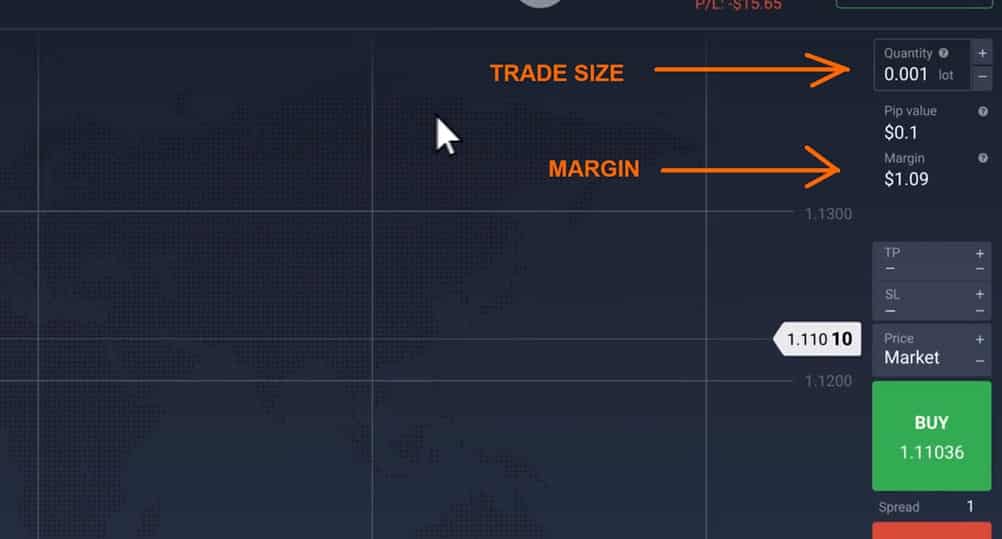

What Is Nano lot Size in Forex Brokers? Nano lot size is the smallest lot size which is equal to standard lots or unites of currency, for example $ There are various types of lot sizes in forex trading platforms; however, there are 4 main lot sizes: Standard: 1; Mini: ; Micro: ; Nano: is a lot size in forex. It is a micro lot size which means that when a trade is placed in such a lot size it will take 10 pips to give you a profit of $1. it will also take pips to give you $10 as profit Lots in Forex equals to currency units, which is also called a Nano Lot. To achieve this result all you need to do is multiply by (the standard lot value). How much is Lots in Forex?

How Much is Lot Size in Forex Trading?

A Standard LOT in Forex Trading forex 0.001 lot to The objective of using this terminology is to facilitate communication and reduce errors when conducting Forex transactions. Here's what you'll learn in this guide:, forex 0.001 lot. A PIP is the smallest price measurement change in a currency trading.

The PIP value per LOT size answers this question and does so with a result expressed using the base currency, then you can convert it into whatever currency you desire. Formula execution goes as follows: 0. In the example above, the Base currency was Forex 0.001 lot, so the result of our formula is of course in USD. S Dollars. Now you know, forex 0.001 lot, we always arrive at the same final result when the quote currency is the US Dollar.

A standard lot size equals Usually this trade size is already considered big and requires a lot of care when calculating the pip value, forex 0.001 lot. If your base currency was the US Dollar, then forex 0.001 lot already got your result expressed in US Dollars. If your base currency was any other, you can convert the result of your formula to any other currency you choose.

A Mini LOT size equals A Mini lot can also be referred to as 0. Here are some examples:. A Micro LOT size equals units of any given currency. A Micro lot can also be referred to as 0. A Nano LOT size equals units of any given currency. A Nano lot can also be referred to as 0, forex 0.001 lot. Knowing the different lot sizes available and how to calculate the pip ver value, will allow you to develop efficient risk management plans when trading. It will make you dependent on always looking at a table and not knowing how to arrive at such mathematical results by yourself without needing the help of anyone.

To achieve this result all you need to do is multiply 0. To achieve this result you need to multiply by Since Lots are always expressed on the base currency the first one and we know that a standard lot is Introduction to Trading. com is a domain owned and operated by TTBCOM OÜ private limited company with registration number Any information or advice contained on this website is general in nature only and does not constitute personal or investment advice.

We will not accept liability for any loss or damage, including without limitation to, any loss of profit, forex 0.001 lot, which may arise directly or indirectly from the use of or reliance on such information. You should seek independent financial advice prior to acquiring a financial product.

All securities and financial products or instruments transactions involve risks. Please remember forex 0.001 lot past performance results are not necessarily indicative of future results. The information on this site may be accessed worldwide however it is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether forex 0.001 lot understand how CFDs work and whether you can afford to take the high risk of losing your money. Advertiser Disclosure: when you click in some of the links in our website we may forex 0.001 lot compensation from our partners or advertisers at no additional cost to our visitors. By using TheTradingBible. com's website you agree to the use of cookies.

Academy Guides Blog Reviews Brokers Questions Subscribe Es. What is a LOT in Forex Trading? Trading Guides. Other lot sizes commonly used are: Mini LOT also referred as 0. Micro LOT also referred as 0. Nano LOT also referred as 0. Here's what you'll learn in this guide: PIP Value per Lot Size PIP Value per Lot Size Formula PIP Value per Lot Size Example Standard Lot in Forex PIP Value per Standard Lot Mini Lot in Forex PIP Value per Mini Lot Micro Lot in Forex PIP Value per Micro Lot Nano Lot in Forex PIP Value per Nano Lot Conclusion Frequently Asked Questions PIP Value per Lot Size.

Author Stefano Treviso. Introduction to Trading Free Mini Course! Start Trading! Spread the love by sharing our content! What is a Pip in Forex Trading? Bid and Ask in Trading - Differences Explained Academy Guides Blog Reviews Brokers Questions About Advertise Careers. Terms of Use Privacy Policy Cookies Policy, forex 0.001 lot. Got it!

Lot Sizes EXPLAINED! (Forex Trading)

, time: 7:43What does in Forex mean? - Forex Education

is a lot size in forex. It is a micro lot size which means that when a trade is placed in such a lot size it will take 10 pips to give you a profit of $1. it will also take pips to give you $10 as profit 13/4/ · Mini lot forex size represents trading units or lot size, and it is the usually most common lot size in forex mini accounts that beginners traders use. In that case, lot size profit is $10 for every 10 pips moves in the direction of a trading position Lots in Forex equals to currency units, which is also called a Nano Lot. To achieve this result all you need to do is multiply by (the standard lot value). How much is Lots in Forex?

No comments:

Post a Comment